Moving to the Charlotte North Carolina area or the Fort Mill, South Carolina area? Looking for information on the real estate market in Mint Hill NC, Matthews NC and the Charlotte NC area? Mint Hill and Charlotte area buyer's agent and real estate expert Rich Ferretti shares market news, advice, moving tips and hot new property trends. http://www.MintHillRealty.com

Sunday, August 30, 2009

Sellers: How to capitalize on the $8,000 tax credit

"If you have a home on the market, getting as many of the "first-time" buyers in as possible right now is even more important than usual," says Rich Ferretti of Jamison Realty, "the typical first-time home-buyer really wants to be able to cash in on the credit, and so they are in a buying mood. And time is running out"

For the first-time home buyer, it is easier to imagine themselves living in a clean, well-cared for, and functional space. As a seller, you can make your home more inviting to buyers by making sure the home-improvement projects are done. Your home will show better and bring in offers faster if it is "move-in ready".

Here are some ways to make your home sell fast to those first-time buyers:

1. Maintain and Stage. A fresh coat of paint and a serious look at decluttering will go a long way, but don't overlook what a professional Home Stager can do for you. Staging professionals boast that the cost of staging will always be less than the first price decrease--so it pays for itself! This will help make the house feel like a home to anyone who comes to see it!

2. Offer to Help Pay Closing Costs. First time buyers especially may need help with points or closing costs. if you can help with this, you will attract many more potential buyers, and may be able to close the one the counts!

3. Offer a Home Warranty. First-time buyers will consider it a huge selling point if you stand behind the house's integrity and that of the major working parts (roof, water heater, AC). You can offer a warranty that will take care of any needed repairs of the major items. Work through your agent to get this on paper, and the message to potential buyers.

4. Offer Mortgage Protection. Mortgage protection covers several months of mortgage payments in the event that the buyer becomes unemployed. This insurance is a great option for most buyers, and first-time buyers may feel especially inclined to choose a home that offers it.

5. Low Offers Aren't Always Bad. Just because an offer is WAY below what you would reasonably take, doesn't mean you shouldn't at least counter. The market is at a place now where buyers feel that they have the upper hand, and are being very aggressive looking for bargains. If you get a super low offer, don't dismiss them immediately, counter with an appropriate number. If they walk away, that is fine, but if they really want the home, you will see them again. Work with your Buyer's Agent to price the home right in the first place, and then to navigate the offers when they come in.

Want more information about the Mint Hill, Matthews and Charlotte area real estate market?

Check out www.minthillrealty.com

Charlotte Market Update from Rich Ferretti: Now is the Time to Buy!

Total state existing-home sales, including single-family and condos, lept 3.8 percent to a seasonally adjusted annual rate of 4.76 million units in the second quarter from 4.58 million units in the first quarter. However, they remain 2.9 percent below the healthy 4.90 million-unit pace in the second quarter of 2008.

Thirty-nine of the 50 states experienced sales increases from the first quarter, and nine states were higher than a year ago; the DC area showed both quarterly and annual rises.

-------------------------------------------------------------------------------------------------

Do you need help finding your dream home? Just tell me what you are looking for and I will search all of our sources and provide you with a convenient report of all the properties in which you may be interested, complete with photographs of the properties and detailed neighborhood information. Now IS the time to BUY!!

After two years of home price declines, does it make sense to buy again? A new study tries to answer that question by looking at two related issues: the home price-to-rent relationship in certain housing markets, and the likelihood that homeowners in today’s market will gain equity in the next five years. Of course, the answer depends on where you’re looking to live and how large of a home you’re thinking about buying. The bottom line: homeownership in the Charlotte area continues to become more affordable compared to rents in most housing markets. Are you renting and not sure if you consider buying a home or not? Contact me and let me assist you in determining if the right choice for you is to Rent or Buy.

If you would like to know the current value of your home, your potential net proceeds, and the benefits of buying or selling now, please contact me. If you have any friends or family that could benefit from my assistance, definitely give me a call.

Below are the highlights of our area's monthly statistics. If you scroll down, you can see all the detailed charts.

June 6 - July 5, 2009

Contracts Reported 2167

Closings 2024

Avg. Listing Price $223,470

Avg. Closing Price $218,728

Avg. Days for List to Close 144.5

Total Active Listings 28,657

Contracts Reported 2341

Closings 2223

Avg. Listing Price $238,629

Avg. Closing Price $212,977

Avg. Days for List to Close 145.2

Total Active Listings 28,150

If you would like a Market Analysis on your property to see how the value has changed, please let me know. You can also sign up for the Market Snapshot report on my website. The report will be emailed to you monthly to ensure you are knowledgeable about the activity in your neighborhood. Just go to http://www.richferretti.com./ and fill in your information within the Market Snapshot box on the right hand side of the page, then click the Next button. You can also search for any properties in the MLS from my website.

Whether you're buying a new home in Charlotte, investing in property or selling a house, feel free to contact me, and I will be happy to help you with all of your real estate needs.

Helping People Home for Over 20 Years!

Rich Ferretti

Realtor/Broker NC/SC

Charlotte, North Carolina

704-564-0807 Direct

http://www.richferretti.com/Rich@RichFerretti.com

Listen to us on the Radio every Saturday from 2-3pm. WBT-Talk Radio 1110am.

Want more information about the Mint Hill, Matthews and Charlotte area real estate market?

Check out www.minthillrealty.com

Sunday, August 23, 2009

Mint Hill NC Homes and Remodeling Projects

Remodeling Projects

That Pay Off

About to start that remodeling project? Read these tips first.

For anyone who has ever put their home on the market, you know that feeling you get when you've spruced up the whole house for sale and inevitably some potential buyer tours your home says: "Maybe we should keep our house and just remodel."

This may be especially true when you look at the cost of replacing your house. According to the National Association of Realtors, U.S. homes have appreciated 6.8% annually on average since 1968, compared with inflation during the same period at an annual clip of 5.1%.

For complete article click here.

Rich Ferretti is your Mint Hill Home specialist..

Mint Hill NC Homes - Tax Credit Update

© 2009 NATIONAL ASSOCIATION OF REALTORS®

All rights reserved.

Item #135-90

(06/09 MC)

Buying a first home is a big step.

Fortunately, trained professionals like

your Realtor® are willing and able to help

you through the process. In addition to

the many benefits of homeownership,

the homebuyer tax credit and more

affordable prices make now an especially

opportune time to purchase. Still, the

commitment is a substantial one, and the

National Association of Realtors®

encourages you to ask questions and

be informed about the decision you are

making so that the home you buy is a

home you can enjoy for years to come.

As part of the Housing and Economic

Recovery Act of 2008 and the American

Recovery and Reinvestment Act of 2009,

a First-time Homebuyer Tax Credit is now

available. But this special

tax break ends in 2009.

A homebuyer tax credit has been

available for first-time homebuyers in

Washington, D.C. for many years, and

now first-time homebuyers nationwide

can take advantage of a similar benefit.

In this brochure we’ll discuss some of the

provisions of the credit, changes based

on the new legislation, and explain how

to use it.

Homebuyers

Tax Credit

Homebuyers

Tax Credit

Buy a home and you get a

tax break!

Other Resources for First-time Homebuyers:

IRS guidance at http://www.irs.gov/newsroom/article/0,,id=187935,00.html

http://www.realtor.org/home_buyers_and_sellers

http://finance.realtor.com/homefinance/guides/buyers/

http://www.hud.gov/buying/

http://www.freddiemac.com/corporate/buying_and_owning.html

http://www.ncsha.org/section.cfm/3/34/2920

REALTORS® who have the Accredited Buyer’s Representative (ABR®)

designation have completed highly specialized training in representing buyers.

To find an ABR® in your area and to receive a FREE Homebuyers Toolkit,

visit www.REBAC.net.

Buying a first home is a

big step! SAVE NOW

with the

Rich Ferretti, ABR is your Mint Hill Homes and Matthews NC Homes Real Estate Specialist..

Call me today.

Friday, August 21, 2009

10 Benefits of Buying By the End Of The Year

It's almost September, and that means we are already in the second half of 2009! It is hard to believe, but before long we will be celebrating a new year.

If home-buying is on your agenda before the end of 09, then you should be aware that in addition to low interest rates, there are other benefits to buying at the end of the year, including:

Motivated Sellers. Many sellers will also be eager to sell by the end of the year. They too want to take advantage of tax write-offs and move-in before the New Year begins. This means you may have more leverage during negotiations. Since we are in a buyer’s market, this could work doubly to your advantage.

Significant Tax savings. If you close on your new home by Dec. 31, 2009, you can deduct your mortgage interest, property taxes and points on your loan on your 2009 income tax return. You can also deduct the interest costs associated with a home equity loan. These deductions can be significant, especially in the early in your loan when you are paying off so much interest.

‘Tis theSeason. It is common for homes to go off the market around the holidays since many sellers won’t want to move at that time. So October and November are great months to go house hunting, and you will find more motivated sellers then too!

Extra Builder Incentives. If you're buying a new house, you can cash in on builder incentives. Many builders include upgrades to sell as many houses as they can by the end of the year—especially in our current market.

Easier Move. The Charlotte weather is great year-round, so you don’t have to worry about hauling all your belongings through a snow-storm! However, being aware of how the seasons can affect moving is important. For example, many moving companies are booked six or so weeks in advance during the busy summer months. So here in Charlotte the fall and winter are easier to secure a moving company on shorter notice.

Home for the Holidays. Everyone yearns to be home with family and friends at the holidays!

Also, you'll enjoy the many homeownership benefits, regardless of what time of year you buy, including:

Paying for something you own. If you're renting, your rent payment goes toward something that will last you only a month. When you buy a house, your monthly payment goes toward something you own.

Consistent payments. Once you secure a fixed-rate mortgage, you can rely on consistent payments.

Because Purple is your Favorite Color. When you own your house, you can update your kitchen, paint your home's exterior in any color you choose…not to mention additions, landscaping, fixture changes and hanging things on the walls!

Equity. As you pay more and more towards your mortgage, you will gradually pay off your principal, meaning you build up equity in your home—an investment in your future!

Call Rich Ferretti, your Mint Hill Homes and Matthews Homes for sale specialist.

When you're ready, I'm Rich Ferretti

Thursday, August 20, 2009

Can a house be sold for less than the mortgage?

This process is called a “short sale,” and occurs when a lender agrees to write off the amount of a mortgage that’s higher than the value of a home. A short sale is complicated process but can keep a homeowner from filing bankruptcy or having to go through a foreclosure. However, a lot will depend on the lender, and often it is dependent on having an offer from a buyer.

The lender will have to approve the sale, and this is a complex procedure--after all the lender has to "write-off" the potential future income from the loan, weighing the risk of not being able to collect on the payment. It takes a competent Realtor to navigate with the home seller and the lender to insure all parties are able to get the most out of an often difficult situation.

A short sale can also get more complicated if the loan has been sold to a secondary market, in which case the lender will need permission from Freddie Mac or Fannie Mae. And if the loan was a low down payment mortgage with private mortgage insurance, the lender also will need to involve the mortgage insurance company that insured the low down payment loan.

Unlike when you are buying a home, if you are trying to short-sell you will need to prove you are broke, instead of your credit worthiness. Also the difference between your home’s value and the balance on your mortgage is taxable income, and you will have to pay this tax at the end of the year.

A short sale is not a solution for everyone, but it is one that can benefit many who find themselves in a home for which they cannot maintain mortgage payments.

Charlotte area real estate market?

Check out www.minthillrealty.com

Monday, August 17, 2009

Large Home with a Full Basement...

<a href="http://twitpic.com/eanuv" title="Here's a great home with a full basement.... on Twitpic"><img src="http://twitpic.com/show/thumb/eanuv.jpg" width="150" height="150" alt="Here's a great home with a full basement.... on Twitpic"></a>

Rich is your Mint Hill NC home specialist...

Saturday, August 15, 2009

First-Time Home Buyer? Get an Inspection

An inspection insures agains unpleasant surprises and unexpected repairs. No matter if a home is a new build, foreclosure, or seemingly well-maintained older home, there could be small--or big issues that you would want to address before finanlizing the sale.

A standard home inspector’s report will cover:

--> The heating system

--> Central air conditioning system

--> Interior plumbing and electrical systems

--> The roof, attic and visible insulation

--> Walls

--> Ceilings

--> Floors

--> Windows and doors

--> The foundation, basement and structural components.

Buyers often request to have their offer be contingent on the findings of a home inspection, and have it stated in the contract. In some cases, home buyers also may be able to renegotiate their offers because of the results of the home inspection.

Check out www.minthillrealty.com

Mint Hill NC

Looking for a new place to call home? Have you considered Mint Hill NC?

Find out why I call Mint Hill home?

The location, the people and the atmosphere....

Check out www.MintHillRealty.com for more information.

Rich Ferretti is your Mint Hill Homes and Matthews Homes specialist.

Don't wait, call or email me today.

MInt Hill NC Home- What are you waiting for????

Have you discovered Hidden Hills? What a great subdivision. Tucked away off hwy 51 and Lebanon road. Down the road from Pine Lake Country Club.

This home has it all.. I can't say enough. You have got to view the home.

Gourmet Kitchen with Granite Counter

Huge Master down bedroom--you have to see the master bath and walk in closets with all the built ins...

Can you believe this is a walk in closet?????

Professionally landscaped property.

Still don't believe me--check out the virtual tour.

Rich Ferretti is your Mint Hill NC Homes specialist.

Call Rich today--don't put it off any longer

Charlotte NC Homes and Market update

Good Morning...

Here is the latest Housing Market update.

Rich Ferretti is a trusted Real Estate Professional serving the Charlotte NC area, specializing with Mint Hill Homes, Mint Hill Relocation, Matthews NC Homes and Matthews Real Estate.

Call Rich today for the latest information covering this area of the country.

Thursday, August 13, 2009

Mint Hill NC and Matthews NC Housing Update

Not sure if the Govt will do anything at this time so my advise is to jump on the wagon and let's get you into a home today. Mint Hill NC Homes and Matthews NC Homes have never looked better.

The tax credit is still on the table and you have to close by Nov 30.

Confused about the home buying process....call or email me today.

Rich Ferretti, your Mint Hill Home Specialist. Also covering Matthews NC and the greater Charlotte NC home market

Want more information about the Mint Hill, Matthews and Charlotte area real estate market?

Check out www.minthillrealty.com

Mint Hill NC and Charlotte NC Real Estate

RISMEDIA, August 13, 2009-RealtyTrac® (www.realtytrac.com), a leading online marketplace for foreclosure properties, has released its July 2009 U.S. Foreclosure Market ReportTM, which shows foreclosure filings - default notices, scheduled auctions and bank repossessions - were reported on 360,149 U.S. properties during the month, an increase of nearly 7 percent from the previous month and an increase of 32 percent from July 2008. The report also shows that one in every 355 U.S. housing units received a foreclosure filing in July.

“July marks the third time in the last five months where we’ve seen a new record set for foreclosure activity,” noted James J. Saccacio, chief executive officer of RealtyTrac. “Despite continued efforts by the federal government and state governments to patch together a safety net for distressed homeowners, we’re seeing significant growth in both the initial notices of default and in the bank repossessions.”

Contact Rich Ferretti, your Mint Hill NC Homes and Matthews NC Home and Real Estate specialist.

Tuesday, August 11, 2009

Mint Hill NC Tax Advantage

The $16,000 Advantage

Are you utilizing ALL incentives and programs for first-time home buyers in 2009!

Tax Credit

The stimulus plan that President Obama signed into law contains an $8,000 tax credit for qualified first-time home buyers. This credit does NOT have to be repaid to the government, as long as they stay in the home for at least 36 months after the purchase date. A tax credit reduces dollar for dollar the amount of tax owed. A deduction merely reduces the amount of income that is taxable. This means the home buyer credit can be claimed even if the taxpayer has little or no federal income tax liability to offset.

First-time buyers or anyone who hasn't owned a home in the 3 years prior to a purchase of a primary residence may qualify for a tax credit of up to 10% of the purchase price or $8,000, whichever is less. To qualify for the credit, the buyer's income must be less than $75,000 for single taxpayers and $150,000 for married taxpayers filing a joint return. Partial credit is proportionally reduced for incomes under $95,000 (single) or $170,000 (married). For married taxpayers, the homeownership history of both the home buyer and his/her spouse are taken into account.

The $8,000 tax credit is available for qualifying home purchases made from Jan. 1, 2009, until Nov. 30, 2009. To receive the credit you must purchase a qualified home before December 1st, 2009 – NOT the end of the year.

NC Housing Finance Agency / FirstHome Program with Down Payment Assistance Program (DAP)

The NCHFA offers other avenues for first-time home buyers with lower incomes (limits apply per county). One is the FirstHome with DAP. This program combines a FHA fixed rate first with the Down Payment Assistance Program (which is a 0% interest deferred second mortgage up to $8,000) that is applied to the FHA down payment requirement and/or closing cost with a minimum investment of $1,000 from the buyer(s). Repayment conditions apply.

This program is for primary resident purchases of SFR – detached, FHA approved Condos and PUDs and new or never occupied double-wide mobile homes, with no minimum loan amount and maximums up to $220,000 for new construction and $210,000 for existing homes. Even incomplete construction up to 75% finished.

Call Rich Ferretti, your Mint Hill NC homes and Matthews NC homes specialist.

Saturday, August 8, 2009

Friday, August 7, 2009

12809 Hidden Hills, Mint Hill, NC: OPEN HOUSE

This is an exceptional home located in beautiful Mint Hill and has been meticulously maintained.

Trust me...once you see this home, you'll know what I mean.

See you this Sunday.

Rich

Check out www.minthillrealty.com

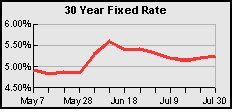

Mortgage Rates

U.S. averages as of July 30, 2009:

U.S. averages as of July 30, 2009: Check out www.minthillrealty.com

Visit Rich Ferretti on Active Rain

You can find great local Mint Hill, North Carolina real estate information on Localism.com Rich Ferretti is a proud member of the ActiveRain Real Estate Network, a free online community to help real estate professionals grow their business.

About Me

.jpg)

- Rich Ferretti Charlotte NC

- Charlotte North Carolina Real Estate Professional. Visit our site www.RichFerretti.com